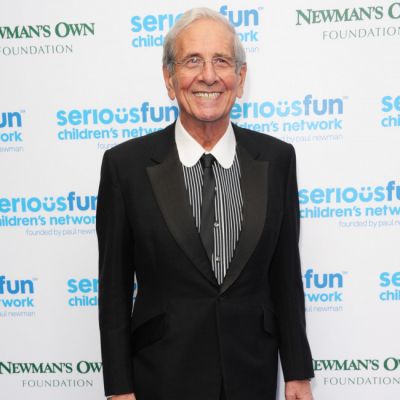

People are interested in Nick Hungerford’s Net Worth in 2023. Nick has been a Venture Partner for Portage Ventures alongside Sagard since 2017.

Top 1,000 Londoners

Nick was named one of the “top 1,000 Londoners” by the Evening Standard and Spears Entrepreneur of the Year, but he wasn’t always successful.

He had to use his credit cards to pay Nutmeg’s first employees,

Nick is enthusiastic about financial education and equality,

and he is a frequent television guest and visiting professor at institutions throughout the world.

Nick has spoken at Stanford, Harvard, Oxford, Cambridge, and the London Business School, as well as appearing on the BBC, CNN, CNBC, and Bloomberg.

Continue reading to learn about Nick Hungerford’s net worth in 2023.

Nick Hungerford Net Worth in 2023: Salary And Achievements

People are curious about Nick Hungerford’s net worth.

Nick Hungerford, the founder and CEO of an internet investment firm, is estimated to be worth $1 billion (£620 million).

Nick developed Nutmeg, Europe’s most comprehensive online investment management service,

and oversaw its development, $100 million in funding, and rumored $1 billion sale to JPMorgan.

Nick is the recipient of the Spears Entrepreneur of the Year award, a member of the European Power 50,

and a digital ambassador for the United Kingdom Department of International Trade.

Nick worked as a Divisional Director for Barclays in the product, trading, and wealth management sectors prior to joining Brewin Dolphin PLC.

Hungerford’s net worth is estimated to be in the millions of dollars.

Nick actively advises and invests in a wide range of technology-driven companies.

He was a founding non-executive director of Innovate Finance, which represents the United Kingdom’s global fintech sector.

Nick is currently residing in Washington, D.C., in the United States.

Nick holds an MBA from Stanford University as well as a bachelor’s degree from Exeter University in the United Kingdom.

He is a Global Entrepreneur Program participant and a Securities Institute Fellow.

As a volunteer, Nick teaches entrepreneurship and behavioral finance at many colleges.

Nick Hungerford’s Professional Qualifications

Nick is commonly referred to as the “go-to guy” by CEOs and boards of financial services businesses,

and he has advised many of the world’s leading banks and asset managers on how to adapt their products and services to appeal to a new generation of customers.

He has also been able to provide leaders from worldwide non-financial services companies and governmental bodies with a fresh perspective.

Nick founded Nutmeg, Europe’s first and largest Robo adviser,

as one of the leading specialists in financial technology innovation and entrepreneurship.

As the pioneer of online “robo” investing, Nick transformed a 300-year-old industry by developing a service that provides services akin to private banks to a broader user base.

This company originated in a Silicon Valley garage and has now grown to become London’s leading personal investing brand.

Also read:

Anthony McRae, an MSU shooter, is the son of Michael McRae and Linda McRae.

Is Anjali Arora’s boyfriend Akash Sansanwal? Twitter Viral Video and MMS Leak

Nick is presently based in Singapore,

Where he invests in start-ups and works with large multinational corporations to digitally restructure their operations.

Fees range from 0.3% for deposits of £1,000 to £25,000 to 1% for deposits of £500,000 or more.

According to the firm, underlying fund expenses are typically 0.19 percent,

compared to an average of 1.58% for active funds in the United Kingdom.

A drawdown service is also in the works.

For a comparable price, investors can build up an Isa or a personal pension with the company.

However, Hungerford admits that, despite multiple efforts to emphasize the benefits of the Nutmeg service over competitors, convincing investors to switch takes time.